florida estate tax exemption 2021

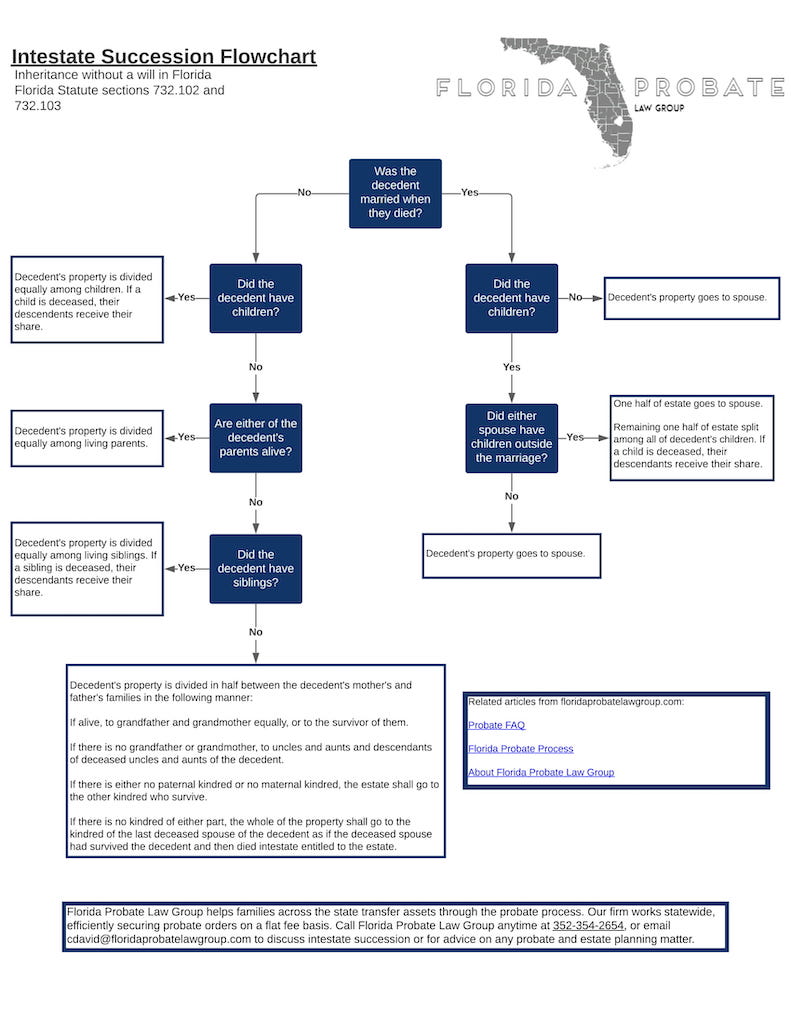

To be eligible for the exemption Florida law requires that political subdivisions obtain a sales tax Consumers Certificate of Exemption Form DR-14 from the Florida Department of Revenue. The federal estate tax exemption is the amount excluded from estate tax when a person dies.

The Complete Guide To Florida Probate 2022 Florida Probate Blog January 2 2022

With portability they can take the savings with them up to a maximum of 500000.

. Amusement machine receipts - 4. 1121 section 1961975 FS PDF 174 KB DR-504W. Ad Valorem Tax Exemption Application and.

Florida Estate Tax Return for Residents Nonresidents and Nonresident Aliens. The estate tax exemption in 2020 was 1158M. However the new rate and other provisions are set to expire in 2025.

Since Floridas estate tax was based solely on the federal credit estate tax was no longer due on estates of decedents that died on or after January 1 2005. Remaining 15000 of value is exempt from non- taxes. Due to the Tax Cuts and Jobs Act signed into law in 2017 the estate tax exemption limit has been gradually increased over the past four years.

Rental lease or license of commercial real property - 55. Unless Congress takes action to make these tax cuts permanent the rate likely would revert back to its pre-2017 level of roughly 549 million. For 2022 that amount is 1206 million.

Assessed Value 85000 The first 25000 of value is exempt from all property tax the next 25000 of value is taxable the third 25000. Dividend exemption uk companies. The estates executor is also responsible for filing the decedents final income tax return and taking care of any other tax obligations.

11580000 in 2020 11700000 in 2021 and 12060000 in 2022. Buyers if you bought your home in 2021 have you filed for Homestead Exemption yet. In Florida either the decedent or the estate needs to pay the property tax bill issued in the fall by March 31st.

Ad Valorem Tax Exemption Application and Return For Nonprofit Homes for the Aged R. East tennessee natural gas pipeline map. In 2020 rates started at 10 percent while the lowest rate in 2021 is 108 percent.

In 2021 the IRS gift tax exclusion was. The lifetime gift and estate tax exemption rose dramatically for instance. So even if you qualify for the federal estate tax exemption The top estate tax rate is 12 percent and is capped.

Sales tax is added to the price of taxable goods or services and collected from the purchaser at the time of sale. Florida estate tax exemption 2021. This year the estate tax exemption in 2021 is increasing to 117M.

Florida estate taxes were eliminated in 2004. November 28 2021. Lone wolf assault climber.

Connecticuts estate tax will have a flat rate of 12 percent by 2023. Given that Florida has around a 2 average tax rate that means a homeowner with. That means that due to this increased estate tax limit in 2021 estates valued at 117M or less will.

Instead individuals and families pay a federal estate tax on transferring property upon death when an estate exceeds a specific threshold also. Floridas general state sales tax rate is 6 with the following exceptions. Get information on how the estate tax may apply to your taxable estate at your death.

One of the most important steps is to make sure that any property taxes are paid. Floridas 2021 Homestead Tax Exemptions. The estate tax exemption in 2022 is approximately 12000000.

Florida Corporate IncomeFranchise Tax Return for 2021 tax year. Retail sales of new mobile homes - 3.

Federal Estate Tax Facts You Should Know So You Can Pass As Much Tax Free Money As Possible To Loved Ones Karp Law Firm

Florida Property Tax H R Block

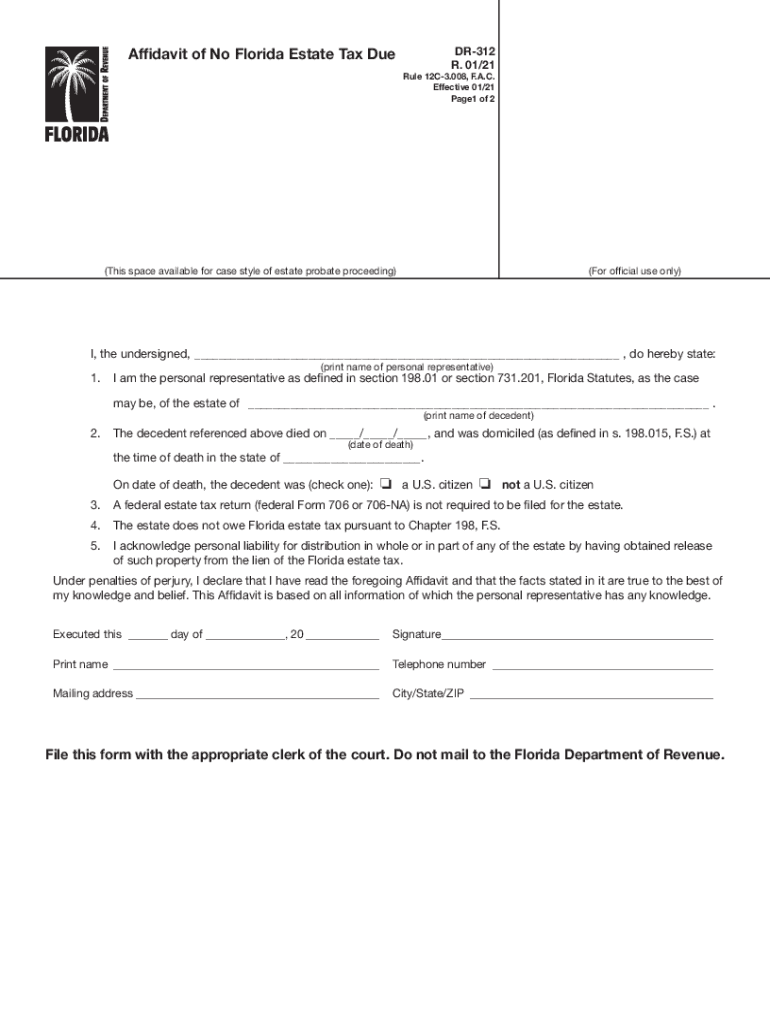

Fl Dor Dr 312 2021 2022 Fill Out Tax Template Online Us Legal Forms

Florida Estate Tax Rules On Estate Inheritance Taxes

Form Dr 312 Download Printable Pdf Or Fill Online Affidavit Of No Florida Estate Tax Due Florida Templateroller

Florida Estate Planning Guide Everything You Need To Know

Does Florida Have An Inheritance Tax Alper Law

Florida Homestead Exemption Martindale Com

Does Florida Have An Inheritance Tax Alper Law

/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition

Does Florida Have An Inheritance Tax Alper Law

2022 Irs Cost Of Living Adjustment Limits Released Boulaygroup Com

![]()

Does Florida Have An Inheritance Tax Alper Law

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

Estate Tax And Gift Tax Changes Coming In 2022 Karp Law Firm